Discover Commercial VRPs (Variable Recurring Payments) and their transformative impact on payments. Learn how they offer efficiency, reduced costs, and enhanced security with Yapily's innovative solutions. We cover everything you need to know about its potential and the rollout of its pilot schemes.

Variable Recurring Payments, or VRPs, are taking the payments world by storm as they provide a similar result to Direct Debits, but at a lower cost, less risk of fraud, and offer a better experience. But what are Commercial VRPs and why are they the next big thing in payment innovation?

Variable Recurring Payments, or VRPs, are taking the payments world by storm as they provide a similar result to Direct Debits, but at a lower cost, less risk of fraud, and offer a better experience. But what are Commercial VRPs and why are they the next big thing in payment innovation?

We’ve tended to be more familiar with sweeping VRPs, otherwise known as ‘me-to-me’ payments where money can automatically move between our own bank accounts. Rather than payments going through traditional rails, they use an API, such as Yapily, to bypass fees and settle quicker in the receiver’s account. Popular uses are to prevent an account going into an overdraft or for personal investment apps.

New to Variable Recurring Payments? Read our introductory article to find out more and what our clients are saying. Open banking payments are growing in popularity with 70% year-on-year growth and over 8.6 million monthly users as of March 2025. This is amazing progress considering the technology is still well under a decade old. However, this is still some way from the UK government’s call in their recently published National Payments Vision (NPV) for open banking to become a ubiquitous alternative payment to cards.

For this to happen, open banking payments need to be a mainstay of the e-commerce checkout — something they have so far largely failed to do. This is where commercial variable recurring payments (cVRP) will be a game-changer, bringing the convenience of online wallets and card-on-file to the Pay by Bank revolution.

In this comprehensive guide, we’ll explore everything you need to know about cVRP, from how it works to how it’s being rolled out. As this is still a developing technology, we’ll also provide our view on how it should work and what it might look like.

New to open banking? Read our “What is open banking” blog post for essential background understanding.

New to open banking? Read our “What is open banking” blog post for essential background understanding.

Current open banking payments

Single Immediate Payments (SIPs)

Single Immediate Payments (SIPs) are a type of Faster Payment (FPS) that allows for instant transfers of funds between bank accounts. This is how “regular” open banking payments are made. Under PSD2, open banking-initiated SIPs require secure customer authentication (SCA) on each payment, which is highly secure but can cause some friction in the payment process, particularly when wallets and card-on-file already provide a near-frictionless payment experience.

Key characteristics of SIPs:

Instant settlement (typically within seconds)

Secure customer authentication is required for each transaction

Perfect for one-off payments

Limited convenience for recurring transactions

Sweeping Variable Recurring Payments (VRP)

Another element of open banking payments that you may be familiar with is “sweeping” or “me-to-me” payments — commonly termed “Variable recurring payments (VRP)”. Sweeping VRP enables customers to transfer money between their own accounts and was mandated to be provided by the CMA9 banks by June 2022. However, while they are useful for enabling frictionless personal financial management — and have been integral to the rise of personal finance management solutions — they are limited in scope.

Key characteristics of sweeping VRP:

Transfer funds between accounts owned by the same person

Cannot be used for merchant payments

Widely used in personal financial management use cases

Not applicable to commercial use cases

Find out more about sweeping VRP use cases in our blog post, “4 sweeping use cases changing financial products for consumers”

What is cVRP?

Commercial Variable Recurring Payments (cVRP) is a new type of open banking payment that combines the security of SIPs with the convenience of sweeping VRP. With cVRP, users give consent to merchants or other businesses to take future payments of varying amounts initiated through open banking.

Crucially, they only need to provide authorisation during the initial setup phase, meaning there’s no need for repeated authorisation at every payment, as they have already given long-lived consent. This allows businesses to take regular payments similarly to direct debit but also enables one-click checkout as customers’ open banking authorisation is saved on file with the merchant, similar to card-on-file, but more secure.

cVRP vs Card-on-file vs Direct Debit

Feature | cVRP | Direct Debit | Card-on-file |

|---|---|---|---|

Setup Authentication |

|

|

|

Recurring Payments |

|

|

|

User-Defined Limits |

|

|

|

Cancellation Speed |

|

|

|

Settlement Speed |

|

|

|

Fraud Protection |

|

|

|

How does cVRP work?

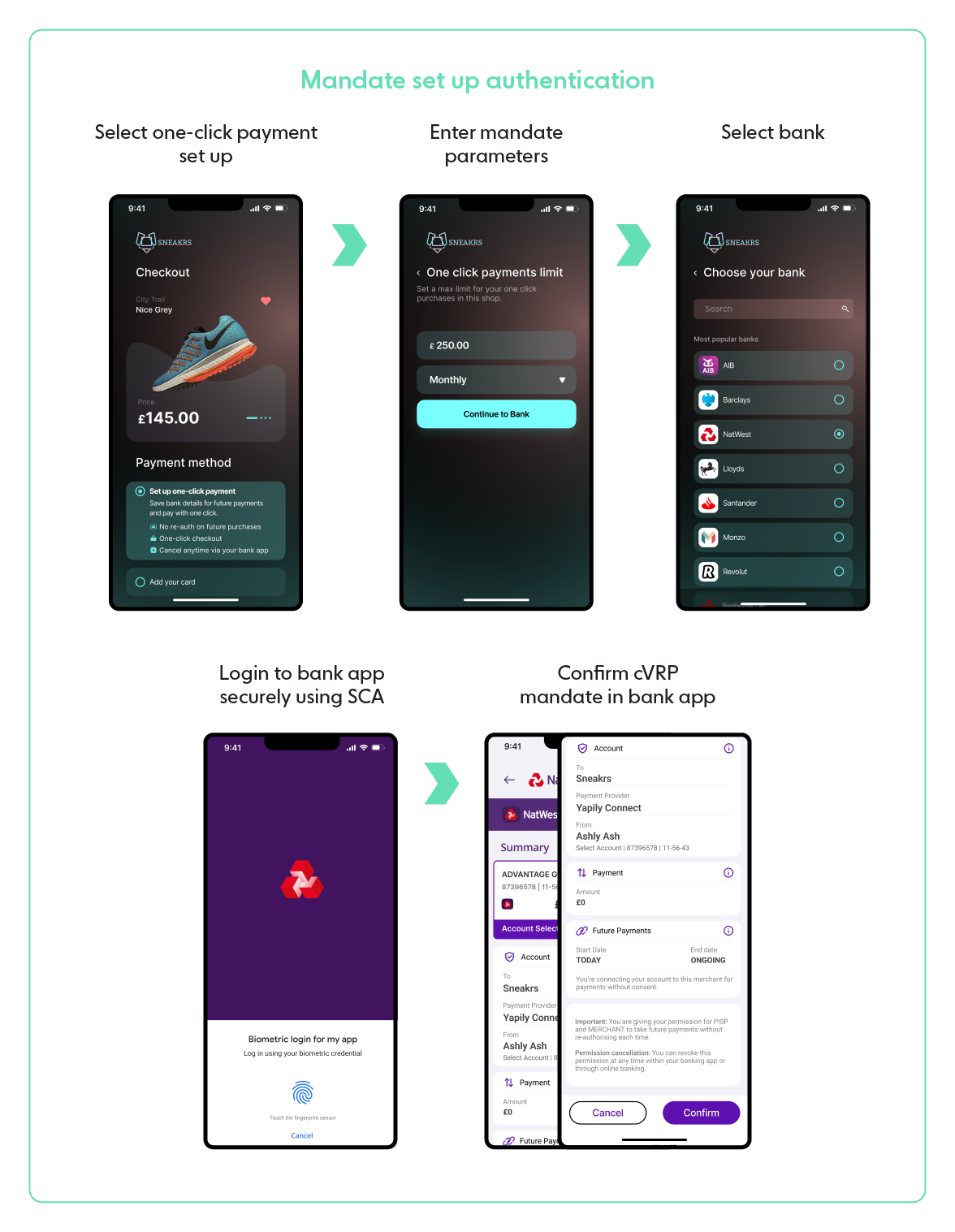

cVRP goes way beyond the capabilities of both direct debit and card-on-file. When setting up cVRP with a new merchant or business, users will be asked to create a cVRP “mandate”.

The cVRP mandate process

When setting up a mandate, users can:

Set payment parameters like payment limits and collection frequency

Define spending controls with maximum amounts per transaction or period

Choose payment timing for regular or variable collections

Access cVRP mandate dashboards in their banking app

Example: How users set payment parameters

When a user sets up a cVRP mandate in their banking app, they might encounter the following options:

Parameter | Example setting |

|---|---|

Maximum per payment | £100 |

Maximum per month | £300 |

Recurring payment frequency | Monthly |

Expiry date | 31 December 2025 |

Merchant | Utility Provider Ltd. |

The mandate dashboard allows customers to:

Edit payment parameters in real-time

Monitor upcoming payments

View payment history

Instantly cancel their mandate at any time

This represents a huge increase in control and security for customers compared to existing payment methods.

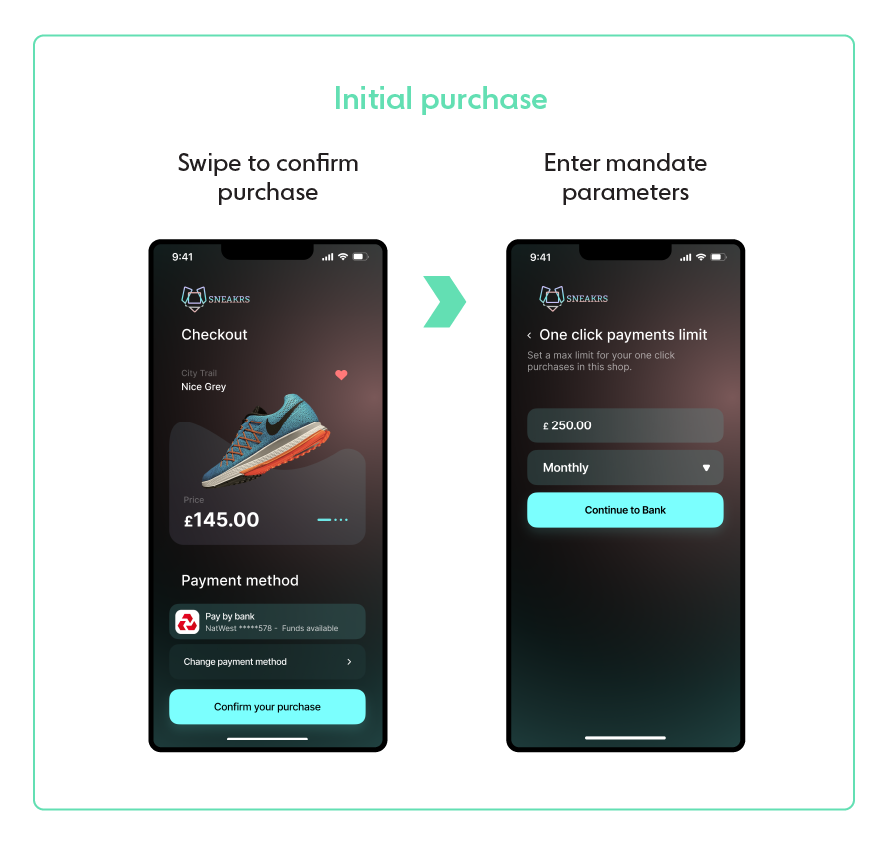

One-click payment experience

Once a cVRP mandate is established, customers can enjoy:

Seamless checkout without re-entering payment details

Balance verification before payment attempts

Automatic retry logic when there are insufficient funds

Real-time payment confirmations

Instant settlement to merchant accounts

Want to see cVRP in action? Book a demo with our open banking experts.

Want to see cVRP in action? Book a demo with our open banking experts.

The benefits of cVRP

We recently published a comprehensive report in collaboration with YouGov, Unlocking the open banking opportunity, where we surveyed merchants and consumers on their core preferences when considering new payment methods.It highlights that both want better security and fraud protection, while merchants specifically want lower-cost transactions and consumers value convenience for low-value purchases. cVRP brings all of these elements to open banking payments, delivering a more complete payment experience to replace direct debit and card-on-file.

Better security

Our research shows that 58% of consumers want a payment method with a lower risk of fraud, while 68% of merchants are concerned about fraud, and 54% are concerned with data breaches. Just like all open banking payments, cVRP mandates require secure customer authentication (SCA) during set-up, virtually eliminating the risk of unauthorised payments. Additionally, end-to-end encryption of open banking APIs and their non-reliance on card details make cVRP a more secure payment method than card-on-file or direct debit, which store details and are therefore susceptible to data breaches and fraud.

Security advantages:

Strong customer authentication at setup

No card details stored or transmitted

End-to-end API encryption

Real-time fraud monitoring

Instant mandate cancellation capability

Greater convenience

Our research shows that consumers prioritise convenience on sub-£100 transactions, particularly from merchants they trust. cVRP brings the convenience of payments in line with card-on-file, fulfilling this key demand for consumers when using open banking as a payment method.

Convenience benefits:

One-click checkout experience

No need to re-enter payment details

Saved payment authorisation with merchants

Mobile-first user experience

Seamless integration with existing checkout flows

Higher conversion

Open banking payments enable merchants to perform balance checks before payments are initiated and funds are taken. This means if a customer doesn’t have the available funds before their payment date, the merchant can send a reminder to ensure they make funds available in time, preventing failed transactions or unwarranted charges to consumers for going into overdraft.

Conversion improvements:

Pre-payment balance verification

Low-fund warnings and payment reminders

Automated retry mechanisms

Reduced failed payment rates

Improved cash flow predictability

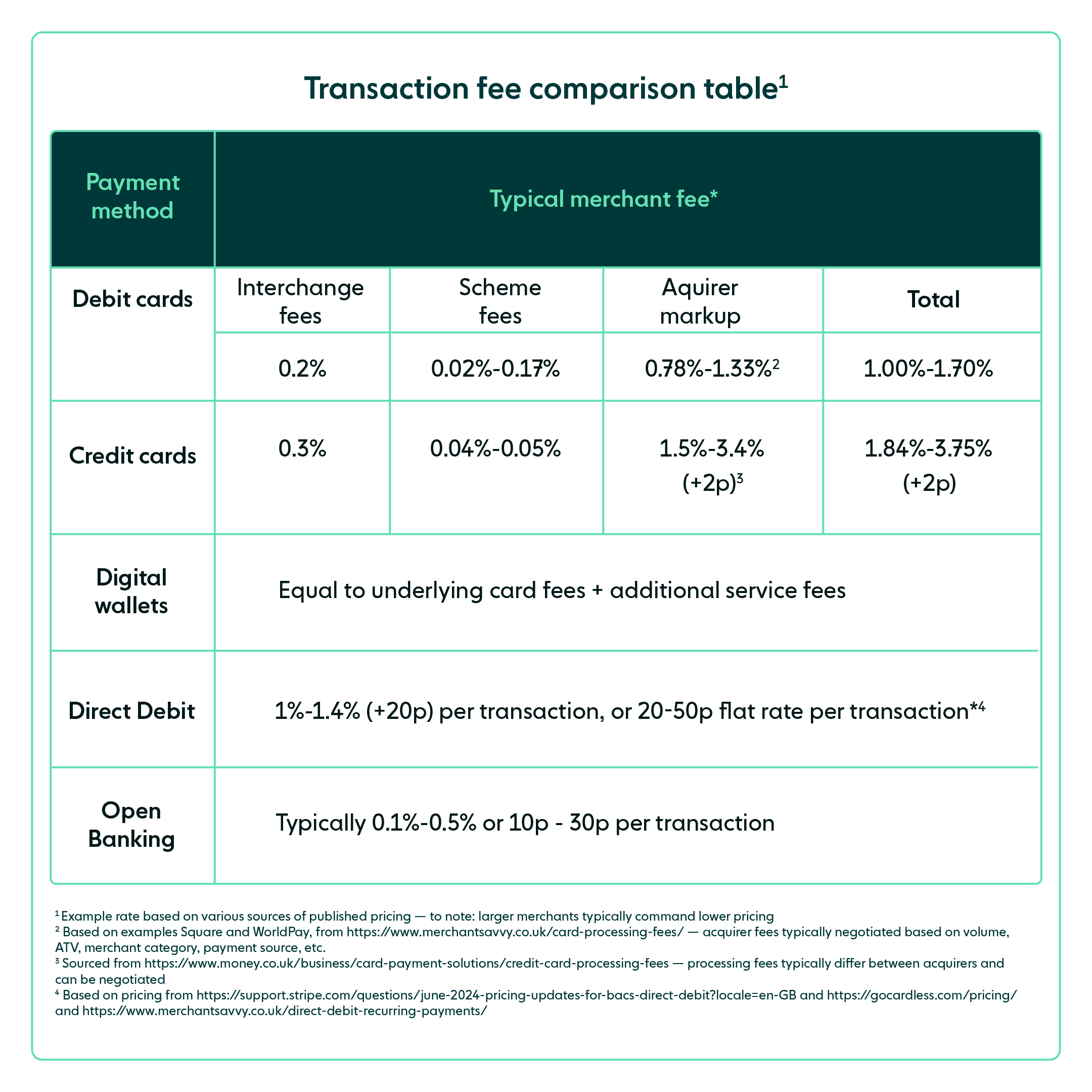

Lower costs

Our research shows 77% of merchants want a payment method with lower costs. Open banking offers significantly lower cost per transaction than other payment methods, and cVRP will increase the volume of transactions made using open banking payments, particularly for e-commerce or subscription services, lowering the overall cost of processing transactions.

Cost comparison (typical rates):

Increased control

The user interfaces and dashboards that allow consumers to view, adjust, and cancel their consents are a requirement of cVRP. Direct debit has fewer controls as consumers aren’t able to set their own parameters, and the slower cancellation process — typically taking several days — means unauthorised payments can still take place.

Control features:

Real-time mandate management

Instant cancellation capability

Spending limit controls

Faster settlement

Unlike direct debits, which can take up to three working days to clear, open banking payments through cVRP settle instantly. This provides more reliable and predictable cash flow for merchants, helping them forecast and run their business more efficiently while protecting consumers from potential issues with late payments.

Settlement benefits:

Instant fund availability

Improved cash flow management

Real-time reconciliation

Reduced working capital requirements

Enhanced financial planning capability

The rollout of cVRP

The National Payments Vision (NPV) highlighted the potential for cVRP to become a true alternative payment method:

“Open Banking, with its significant untapped potential, has a vital role to play in achieving this ambition in the near-term – in particular, through unlocking account-to-account payments for e-commerce.”

But for cVRP to achieve its full potential, supportive regulatory frameworks that provide clarity, security standards, and consumer protections are key.

cVRP’s staggered rollout strategy

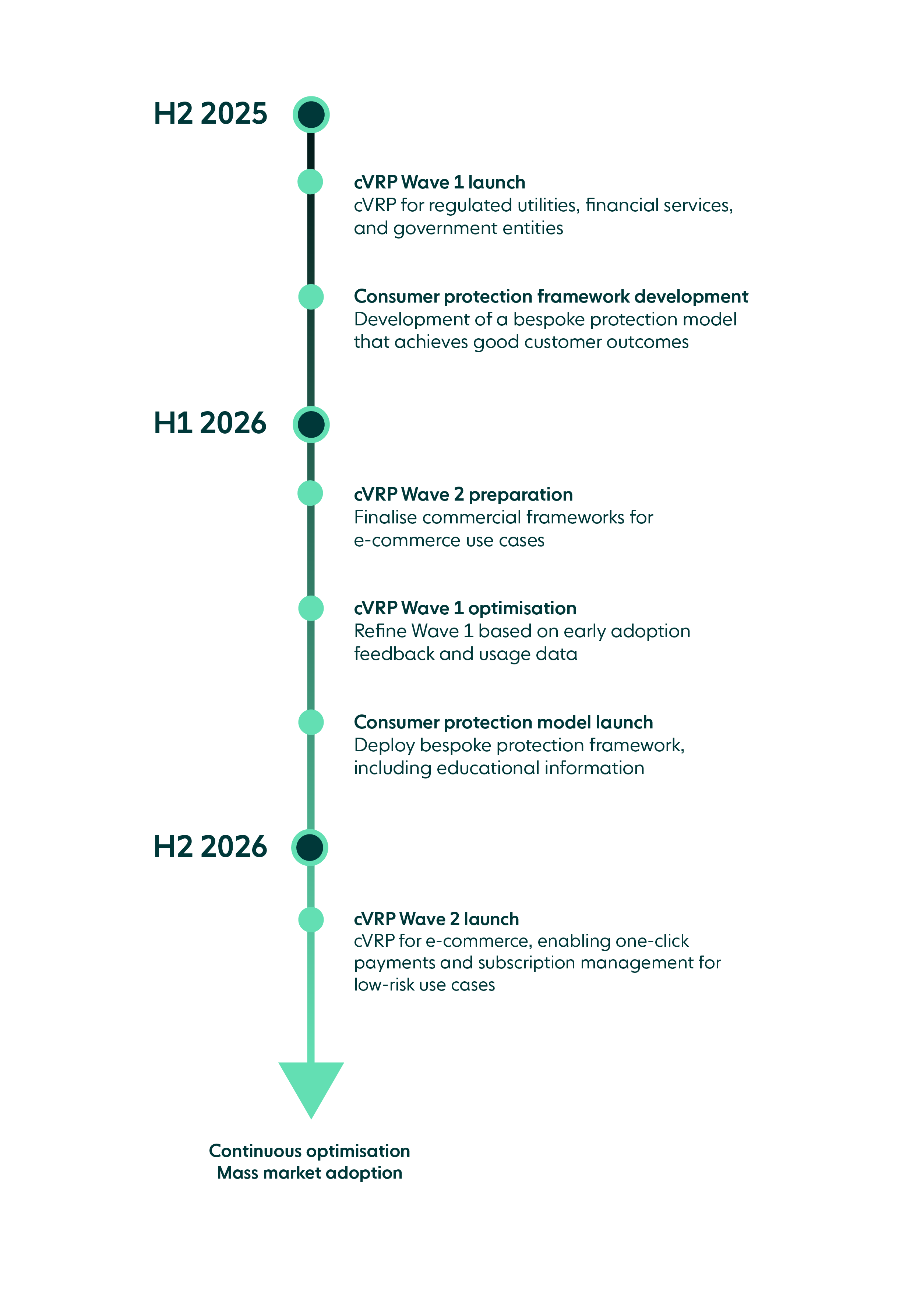

cVRP will be strategically rolled out in “waves” to ensure careful implementation and risk management. The rollout is expected to commence from Q4 2025 for Wave 1, with e-commerce applications (Wave 2) expected to follow in 2026.

This phased approach allows the industry to evaluate performance, identify potential issues, and refine the cVRP framework before broader implementation across more diverse applications.

cVRP Wave 1: Building the foundation

Timeline: Second half of 2025

Wave 1 will focus on low-risk use cases that typically involve transactions with trusted and regulated entities where consumer protection frameworks are already robust.

The initial deployment prioritises regulated sectors such as utilities, rail, government services, charities, and financial services firms, where predictable but flexible payments are a critical user need. These verticals represent both high-volume use cases and trusted institutional relationships, making them ideal candidates for early adoption.

Read our Wave 1 overview to discover if your business might be a good fit for our pilot scheme

Wave 1 use cases (officially defined)

Utilities and rail companies: cVRP payment transactions to electricity, gas, water and telecoms providers (including broadband, fixed phone lines, mobile phone service contracts), and for rail tickets.

Regulated financial Services firms: cVRP payments into financial products/accounts eligible for FSCS protection (such as deposits, insurance and investments), pension schemes and mortgages.

E-money institutions: cVRP payments into electronic money accounts provided by Electronic Money Institutions authorised by the FCA.

Government (central or local): cVRP payments to designated government departments, agencies, public bodies, local authorities and TfL.

Registered charities: cVRP for charitable donations to registered charities.

Key benefits for Wave 1 sectors:

Enhanced customer control through accessible dashboards and clearly defined payment parameters

Greater transparency over recurring payments compared to traditional direct debit

Instant settlement compared to the 3-day clearing period for direct debits

Reduced payment failures through pre-payment balance verification

See cVRP for Wave 1 in action with our example flow for investment apps

cVRP Wave 2: Expanding to e-commerce

Timeline: Expected H2 2026

Wave 2 represents cVRP’s expansion into mainstream e-commerce, with UK Finance leading the development of the commercial model for these use cases. The focus shifts to e-commerce use cases that would expand cVRP to similar applications as card schemes.

Wave 2 development process

UK Finance is working with members to consider what a commercial model should look like for ‘Wave 2 cVRPs and beyond’, specifically focusing on cVRPs for e-commerce use cases. This work is being coordinated with Open Banking Limited to ensure consistency between Wave 1 and Wave 2 approaches.

Expected Wave 2 applications

While Wave 2 specifications are still under development, industry discussions indicate potential applications in:

Subscription-based services for digital content and SaaS platforms

E-commerce recurring payments for regular purchases

Marketplace settlements for platform-based transactions

Usage-based billing for variable service consumption

Regulatory framework and industry coordination

Multilateral Agreement (MLA) development

A Multilateral Agreement (MLA) will provide the standardised framework for cVRP implementation, setting out common rules, obligations, and governance structures. The MLA defines the rights and obligations of parties, ensuring cVRP transactions are processed securely and consistently.

The MLA addresses:

Technical standards and interoperability requirements

Dispute resolution mechanisms for transaction issues

Liability frameworks protecting all parties

Common access requirements preventing market fragmentation

Independent operator structure

To ensure effective implementation and enforcement of the MLA, an independent Operator has been established. 32 organisations from across the open banking and payments industries, including Yapily, have committed to funding efforts to create this new entity.

Other founding funders include: HSBC, Barclays, Lloyds Banking Group, NatWest, PayPal, Monzo, Revolut, Starling, Wise, Mastercard Open Banking Services UK, and other open banking providers such as TrueLayer, Plaid, and GoCardless.

Market readiness and adoption indicators

Current market momentum

Open banking payments are experiencing 70% year-on-year growth with variable recurring payments now accounting for 13% of total open banking payments. This growth demonstrates increasing market acceptance of account-to-account payment methods, and lays a foundation for cVRP to succeed if an MLA that incentivises cross-industry participation can be established.

Industry collaboration

The collaborative approach to cVRP development demonstrates the industry’s commitment to creating a unified, interoperable payment ecosystem. As noted by Henk Van Hulle, CEO of Open Banking Limited:

“This is a significant moment for the industry. It’s testament to the collaborative nature of our ecosystem that we can deliver this through an industry-led approach.”

What hurdles remain in the rollout of cVRP?

Despite its great potential, support from the UK government, and progress so far, there are currently a few issues that still need to be resolved before cVRP can be fully rolled out.

Getting banks on board, one way or another

For cVRPs to achieve widespread success and become a viable alternative payment method, a supportive regulatory landscape is essential. Ideally, an agreement on a mutually beneficial commercial framework between the CMA9 banks and providers will encourage voluntary API development.

However, should such an agreement not be reached, regulatory bodies may need to mandate banks to provide these crucial additions to their APIs to ensure the full potential of cVRP is realised across the market, driving broader adoption for the benefit of both businesses and consumers.

Addressing consumer protection concerns

Another key area that needs to be addressed is consumer protection in open banking payments. Currently, standard consumer protections enshrined in the Payments Service Regulations (PSRs) 2017 and the Consumer Rights Act 2015 apply to open banking payments.

But the industry doesn’t provide any additional protections like the card networks with their Section 75 for credit card payments or chargebacks for debit card payments. In our recent report, we highlighted the need for the industry to agree on an industry-led, bespoke and proportionate consumer protection model that doesn’t hinder open banking’s core value propositions for consumers and merchants.

With SCA as standard, and the lack of card details in transactions, open banking payments are inherently safer than cards, so they don’t require the same robust additional protections. Agreeing on a consumer protection model is a core requirement for the rollout of cVRP to move forward.

You can read more about our take on consumer protections in open banking in our recent research report — Unlocking the open banking opportunity: A new narrative for adoption.

Shape the future of payments with Yapily

As cVRP moves from concept to reality, we’re helping define the standards, frameworks, and technology that will power the next generation of open banking payments. Our leadership in industry working groups, technical innovation, and regulatory collaboration means that by partnering with us, you are not just an early adopter — you’ll be actively shaping the future payments landscape.

Why join the Yapily cVRP pilot?

We’re currently piloting cVRP with businesses. Whether your business fits Wave 1 (regulated sectors, utilities, financial services, charities, government) or is preparing for Wave 2 (e-commerce, subscriptions, marketplaces, usage-based billing), joining our pilot program offers unique and powerful advantages:

Early mover advantage: Be among the first to access and implement cVRP, giving your business a competitive edge as account-to-account payments scale across the UK.

Active influence: Shape the evolution of cVRP by providing direct feedback to industry working groups and helping refine real-world use cases, technical standards, and consumer protections.

Exclusive insights: Gain priority access to the latest regulatory updates, technical documentation, and best practices, keeping you ahead of market trends.

Tailored support: Receive dedicated onboarding, technical integration guidance, and compliance support from Yapily’s expert team.

Enhanced customer experience: Offer your customers a seamless, secure, and flexible payment solution that’s built for the future.

Brand leadership: Position your business as a payment innovator and thought leader by participating in pilot case studies and industry showcases.

Operational benefits: Reduce transaction costs, improve cash flow with instant settlement, and minimise failed payments through advanced balance checks and controls.

Register your interest today—regardless of whether you fall into Wave 1 or Wave 2 use cases.

Register for the Yapily cVRP Pilot →

Have questions or want to discuss your eligibility? Contact our open banking experts for a personalised consultation and discover how your business can benefit from being a cVRP pioneer.