Intelligent savings

Allow customers to automate sending money to their savings accounts, helping them save more efficiently and work towards their financial goals.

Sweeping VRPs let customers move money automatically between their own accounts from intelligent savings to overdraft protection, improving financial well-being while reducing cost and friction.

Offer effortless, one-click sweeping and auto-payments — from card repayments and overdraft protection to savings top-ups, creating smoother customer experiences.

Enable customers to receive money transferred between their accounts instantly, improving cash flow for more dynamic financial management.

Unlike Standing Orders, Sweeping VRP allows payments to be initiated for variable amounts and on different schedules, all under a single user consent.

Reduce risk with Strong Customer Authentication embedded in every consent authorisation and encrypted APIs, delivering peace of mind for your business and your customers.

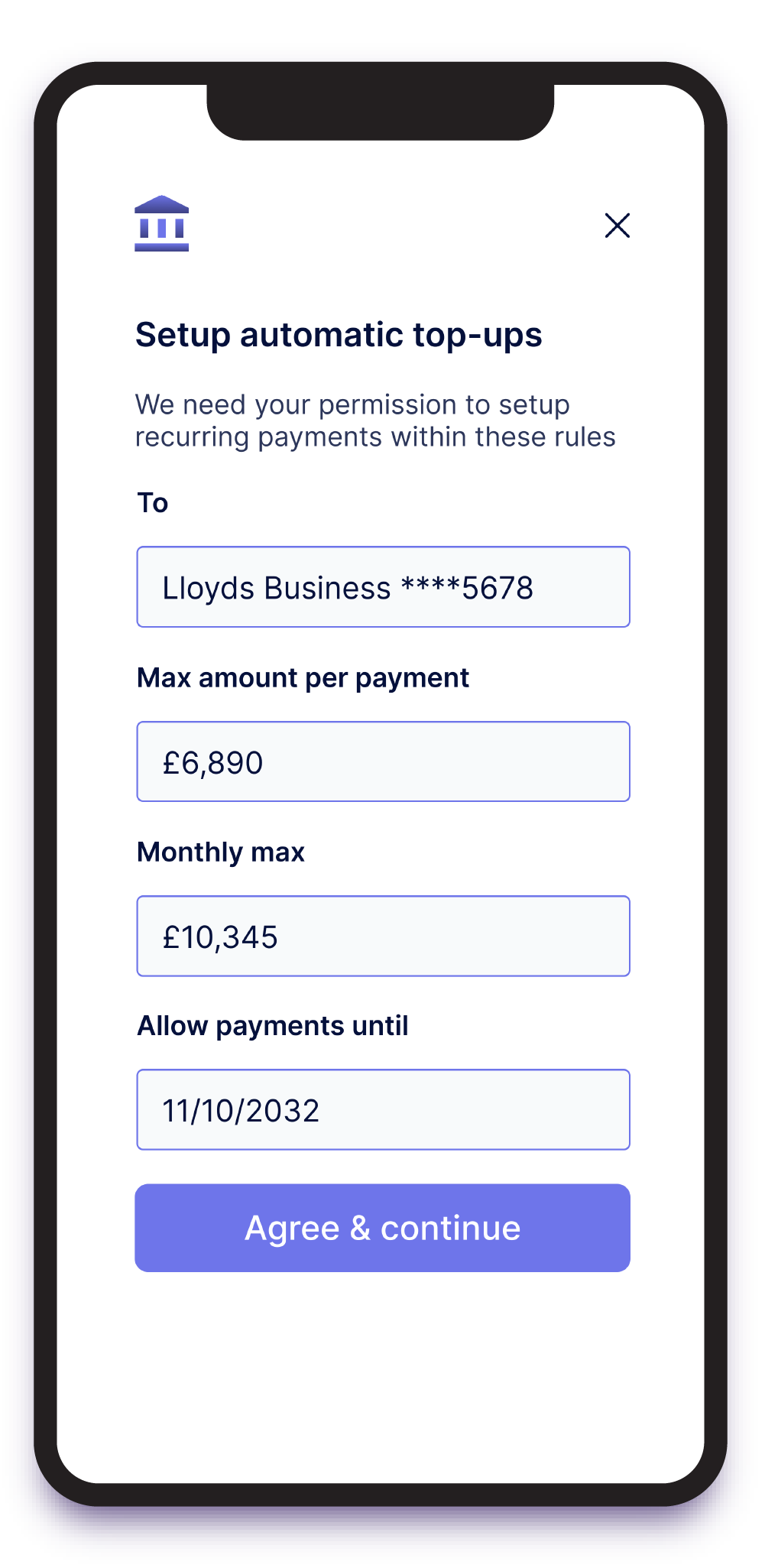

User sets the parameters of their automatic top-ups in the app, selecting values such as the maximum amount and monthly maximum transfer.

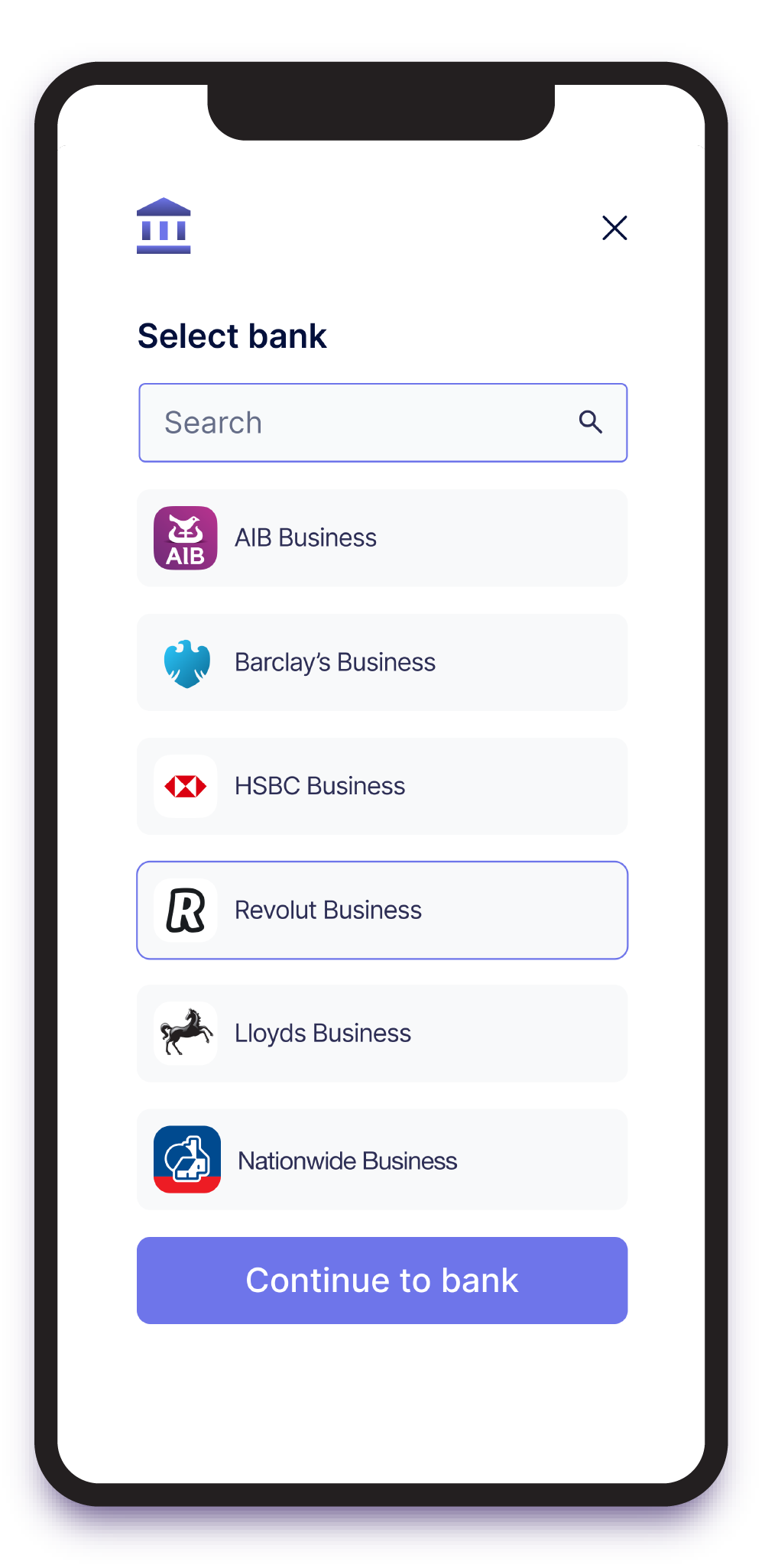

User selects the bank account from which the funds should be swept and logs into their business bank account using secure methods such as 2-factor authentication and protected passwords for extra security.

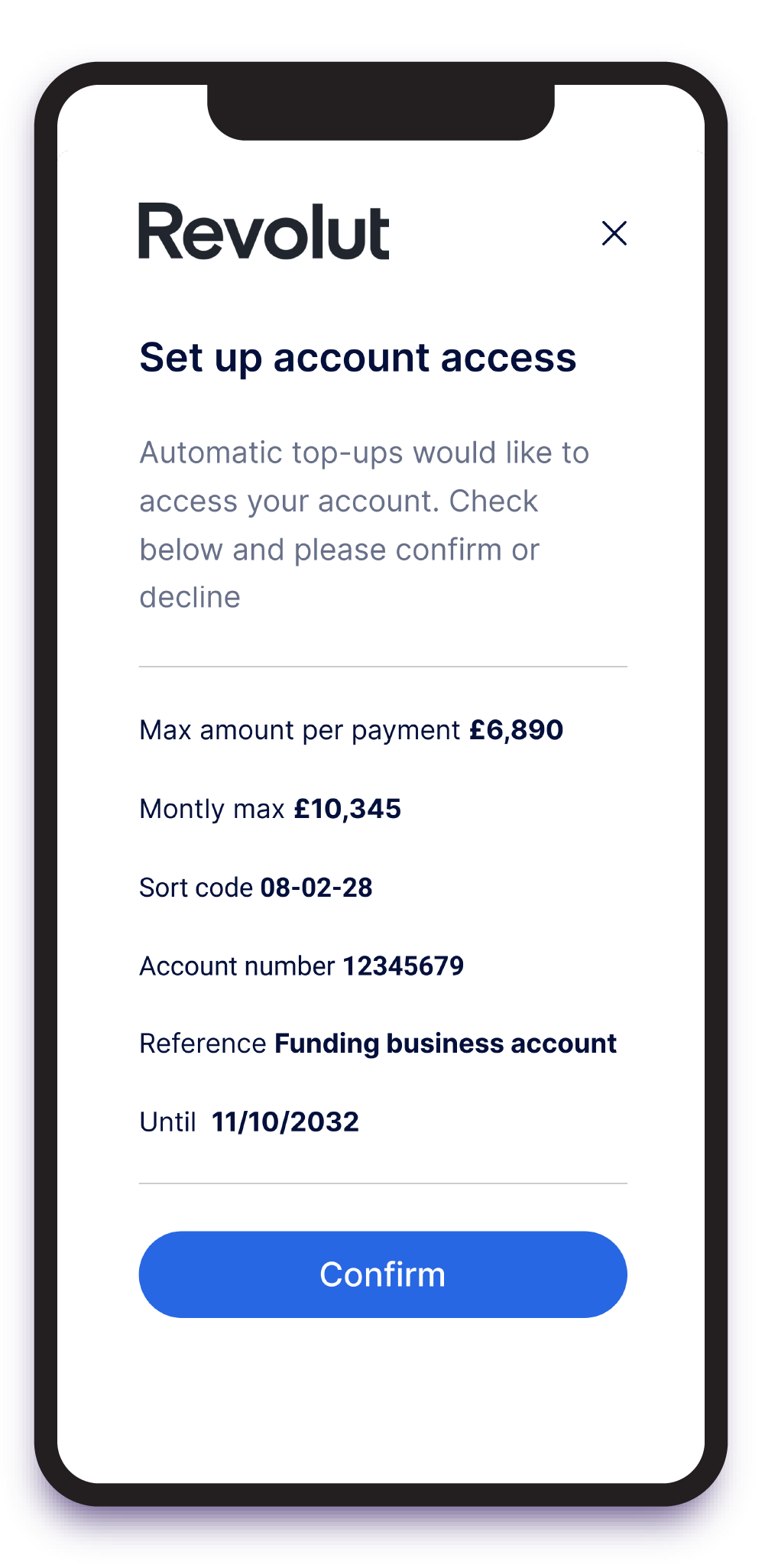

User logs into their business bank account using secure methods such as 2-factor authentication and protected passwords for extra security.

Sweeping VRP is enabled based on the user's set parameters.

With over 87% account reach in the UK, you can offer Sweeping VRP to the vast majority of consumers and businesses across personal and business accounts with major banks.

Explore our coverageA single API integration provides access to all of our banking partners, powering VRP payment use cases for smarter financial management.

Explore our APIGet started quickly without the hassle of applying for an open banking licence. Use our licence via Yapily Connect to get to market faster.

Explore Yapily Connect