Lending

Accelerate credit risk decisions and improve affordability assessments with more accurate categorisation of income, spending, and recurring commitments.

Transform raw bank data into accurate insights that power faster decisions, personalised services, and lower operational costs.

banks across 19 countries

consumer & business categories

recognised merchants for transaction information

Offer your customers a deeper understanding of transaction data pulled from consumer or business accounts, providing valuable insight into spending habits.

Make quicker and more accurate assessments with detailed transaction insights that reduce manual effort and accelerate outcomes.

Reduce overheads from manual bank statement checks and optimise the data available through efficient analysis.

Leverage enriched transaction data to tailor products, pricing, and communications that fuel business growth.

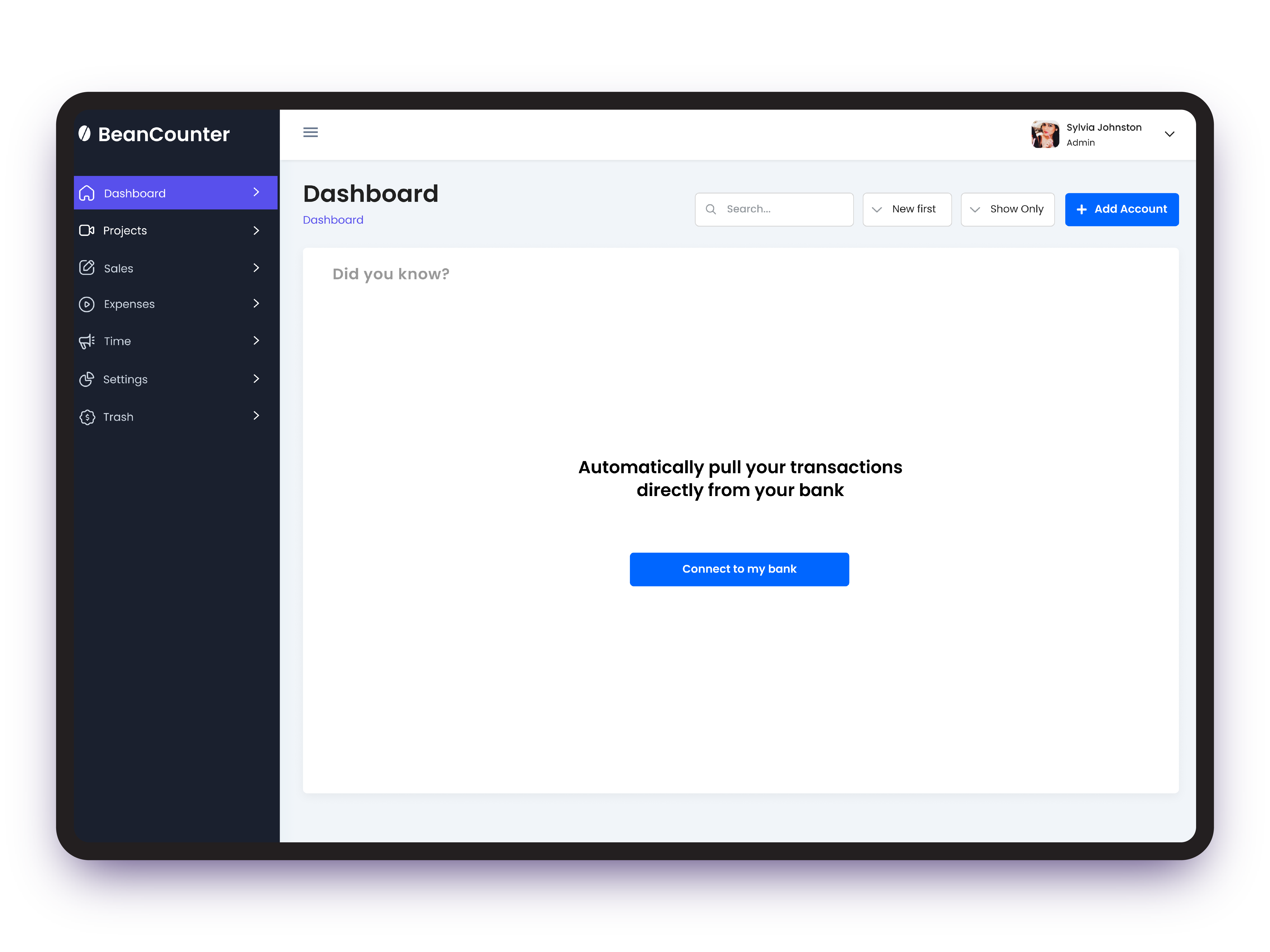

Start by connecting your bank, as you would with a typical AIS account aggregation setup.

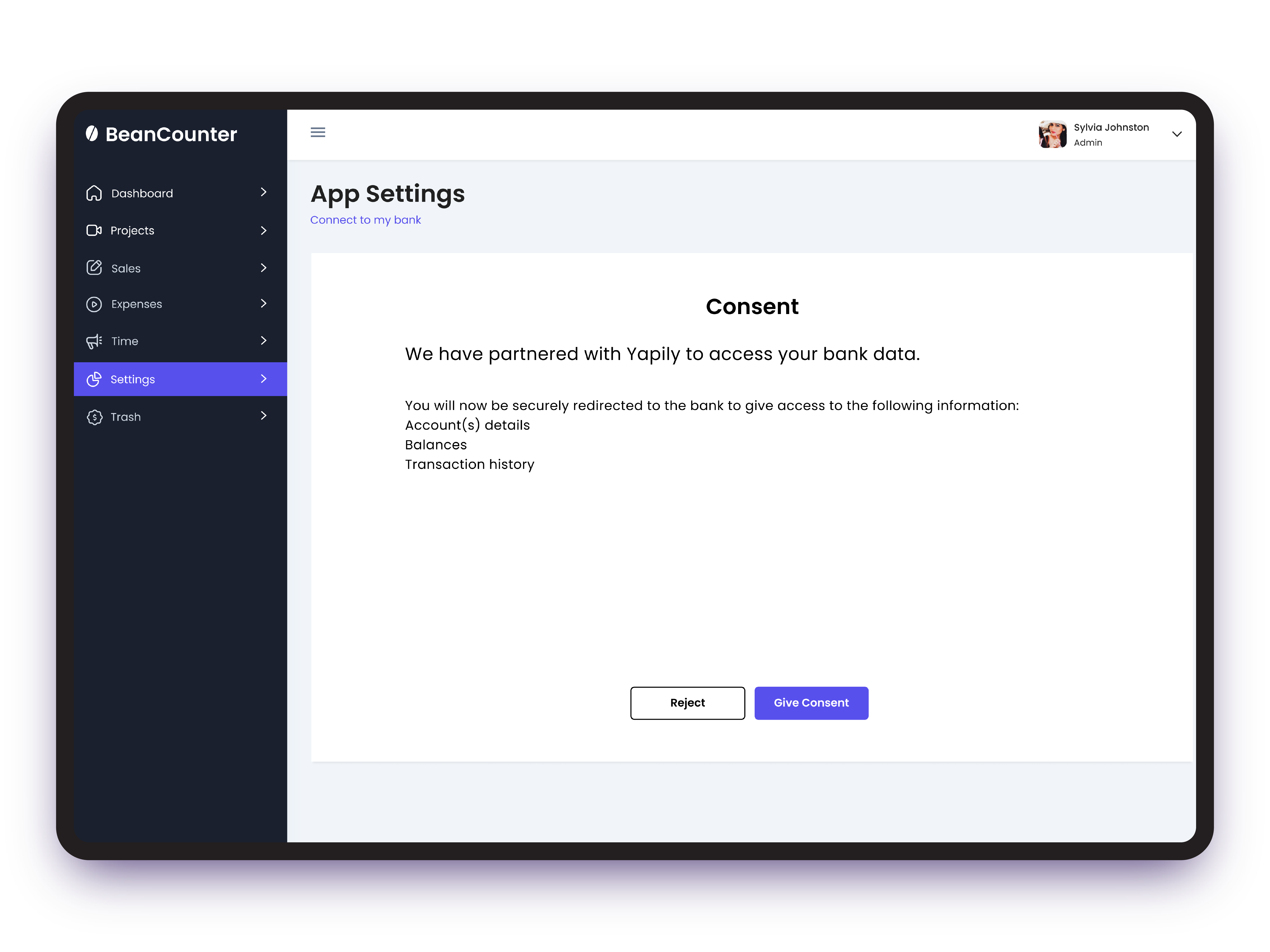

After being notified that Yapily will be providing access to your bank data, and the process of how you will be connected, select "Give Consent".

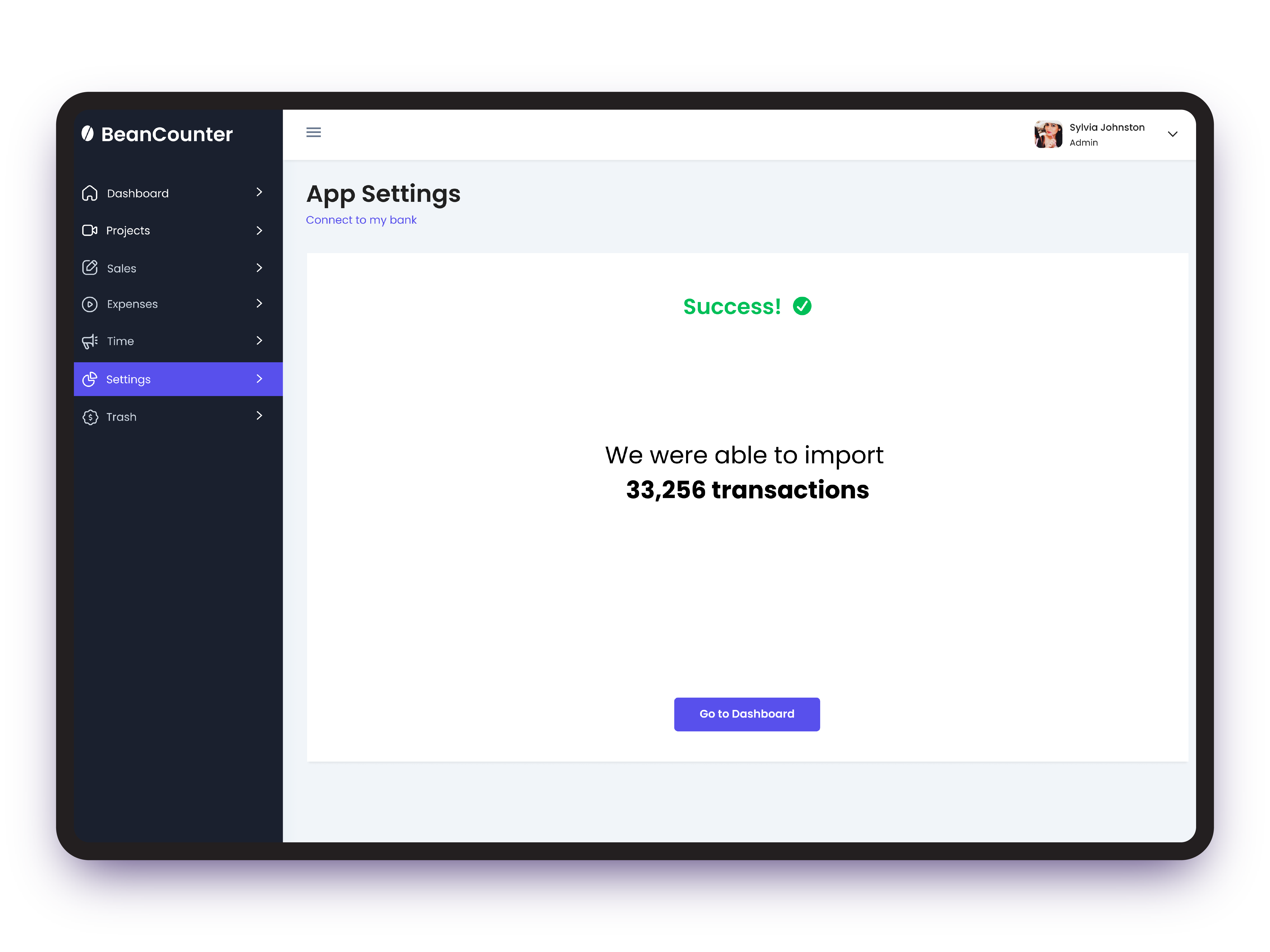

You will be notified of the successful transaction data imports.

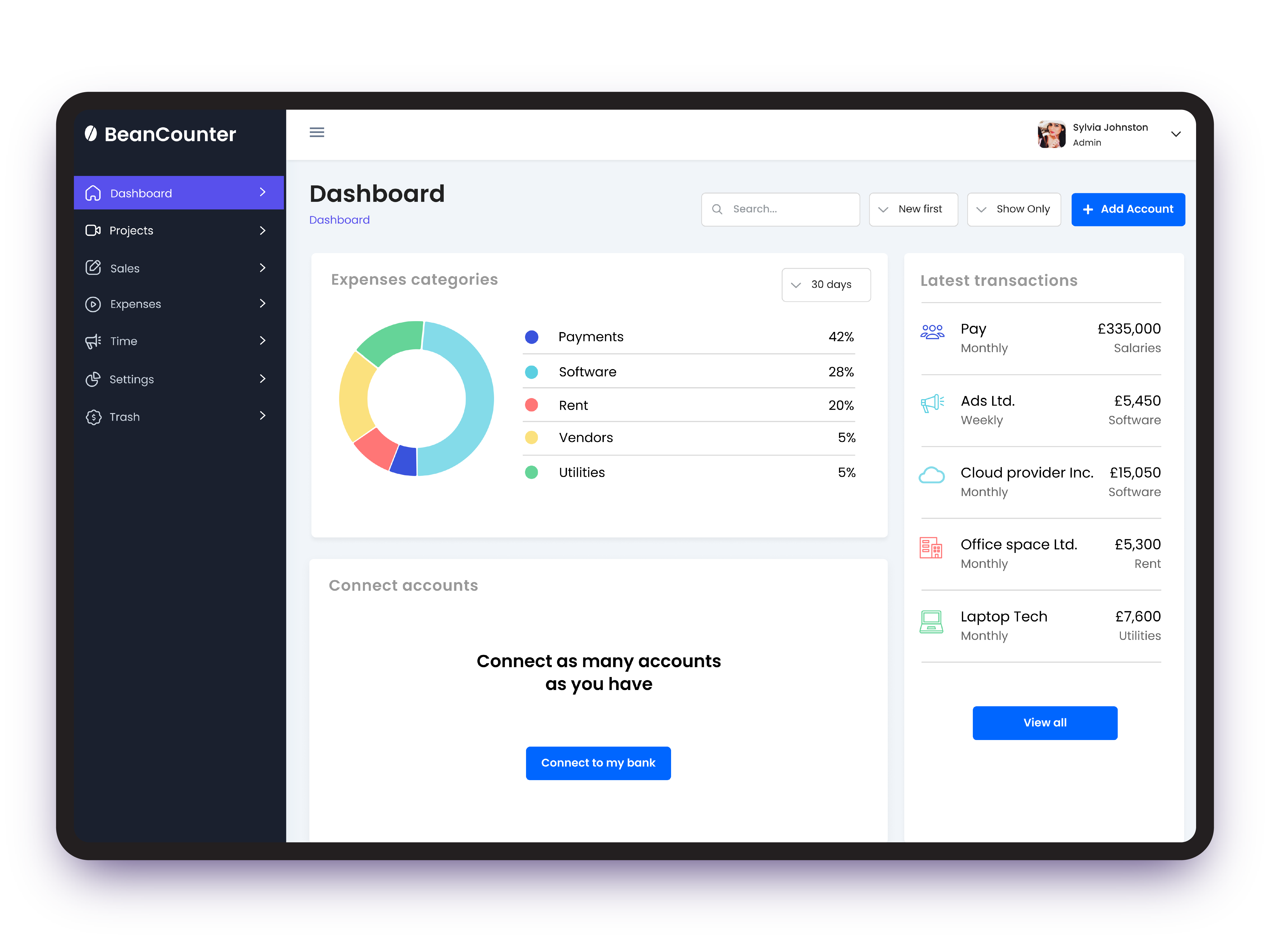

Import data directly into your dashboards, populating them with clean, usable, categorised transaction and enriched transaction data.

Turn messy merchant strings into recognisable names. Identify intermediaries such as processors and provide your data teams with clean, usable merchant information straight away.

Yapily aggregates multiple vendors into one enrichment layer — so you don’t need to contract with or manage multiple providers to scale your use cases. A single integration covers both consumer and SME accounts.

Advanced machine learning models are trained on billions of transactions across the UK and Europe, enabling accurate categorisation and enrichment regardless of geography or language.