Supercharge your efficiency and slash your costs for your accounting business with open banking payments and data. We break down the 8 ways you can transform your business with simply open banking integration. Read on to find out how.

Open banking has made its mark on several industries but in industries like accounting where does it fit? Accounting services need greater support to move away from legacy systems that can lack efficiency or are manually demanding, leaving teams exposed to human error. Accounting to Smart Fintech, open banking technology, like PIS and AIS services, can reduce accounting operations by up to 80%.

Let’s explore the numerous ways open banking can drive greater results for accounting businesses.

How open banking simplifies accounting

1. Bank account validation

It’s time to onboard your customer and you need to validate their bank account to ensure your business is KYC and AML compliant. It also prevents payment loss during setups or payouts. Your business’ normal method requires lengthy processes to verify bank statements, credit checks, and micro-deposits, all of which are slowing down the onboarding experience.

Your KYC checks are smoother than ever and less manual heavy lifting with the automatic input of personal information and business data when you use Yapily Validate and Yapily Data.

Yapily Validate offers accounting and ERP platforms the ability for their customers to request their suppliers to validate their bank account, straight on the platform. This eliminates the risk of invoice fraud and ensures they are only paying a legitimate invoice to a verified supplier.

Yapily Data can enable quick and simple retrieval of account details during onboarding, or prior to setting up a direct debit, so set up is easy and it’s only validated data from the banks. Less friction, reduced risk of fraud, and fewer operational costs for your business.

2. Financial data aggregation

Accounting companies are often stuck with manual methods of data collection by using bank statements and logging into multiple online portals in order to try and create a complete and accurate financial profile. This requires information from multiple accounts, numerous details to remember, and not a guarantee the information is easily accessible. Overall, we see a slow process with friction and a poor customer experience.

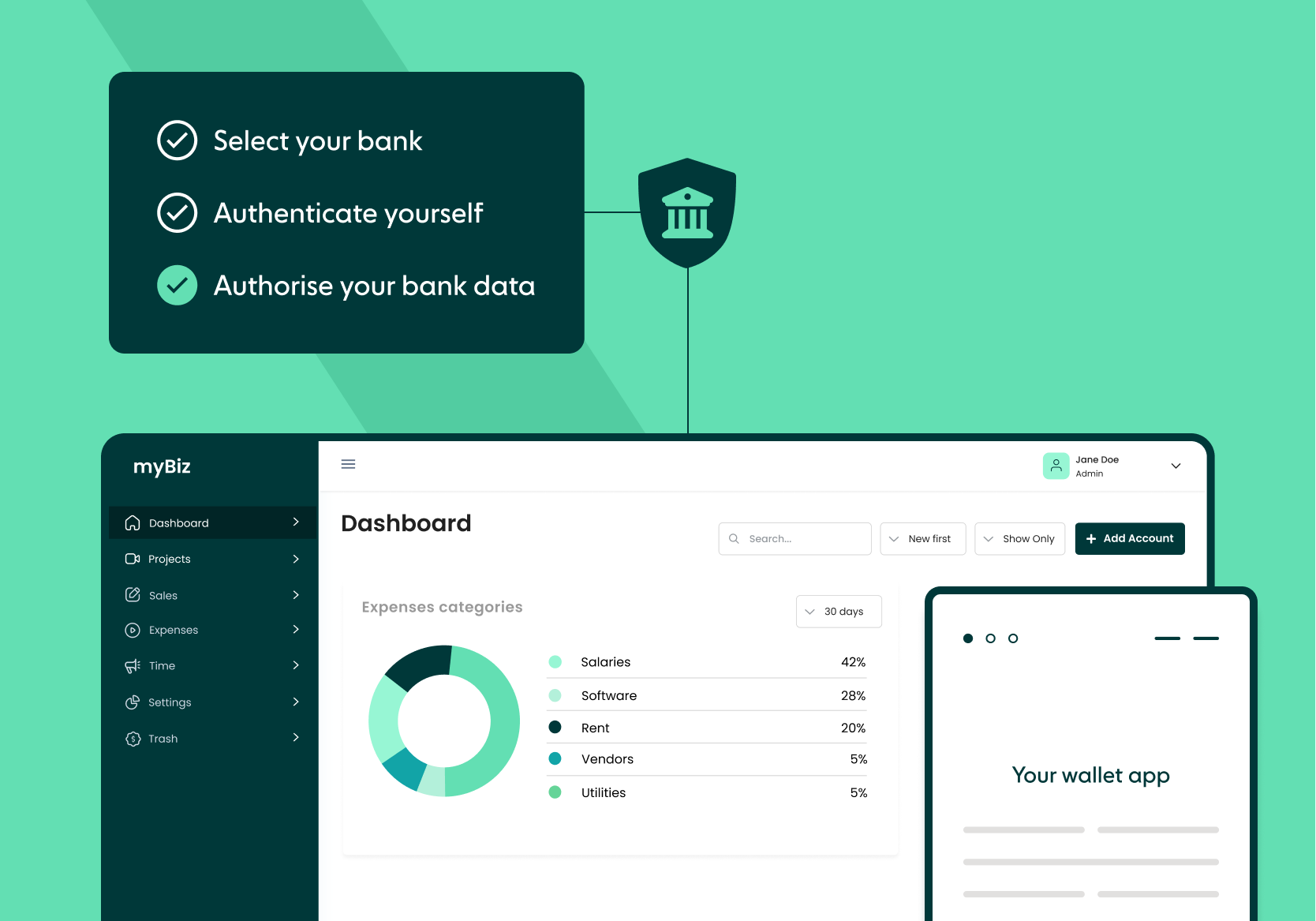

By using open banking, customers can use a third-party provider to connect their bank accounts in order to establish real-time feeds of aggregated bank account data. Unlike screen scraping, no user credentials or passwords are stored, enabling a safer and more secure experience. Instead, users are simply required to authenticate themselves via Strong Customer Authentication (SCA) to grant their content for access.

3. Automation and reconciliation

Uploading documents and extracting relevant information from bank statements are manual methods for payment reconciliation that take time. They also cause friction and can be prone to errors and fraud. Open banking can change this.

When your customers link their bank accounts, it’s simple to import account data in real-time. That’s their balances, account information, transactions, all directly into your platform for easy automated reconciliation. So now there’s no room for error and no manual headache for statement uploading. Experience greater efficiency and conversion.

4. Cash flow management

When your customers need to manage liquidity, reduce risk, and keep the cash flow uninterrupted, issues from accounting can impact this. Consider poor invoice management, long settlement times, inaccurate forecasting. All impact their funds and can have severe consequences.

By utilising A2A payments for tasks like invoice payments or e-commerce checkout, the settlement times are shortened by using Faster Payments or SEPA Instant rails, facilitating faster access of funds. With improved cash flow management, forecasting becomes more effective. Not only that, by using data, the balance of inflows and outflows are accessed in real-time for better visibility and ability to prepare for late payments, surpluses, or unexpected costs.

5. Account & wallet top-ups

A common problem for accounting is expensive card payments, which can be particularly difficult with high value amounts. Asking customers to make manual transfers requires leaving the platform, going to their online banking app and input of their account details. Time-consuming, clunky and prone to mistakes, all of which impact your conversion rate.

Why not introduce open banking for easy account top-ups? Customers can easily fund their account with A2A transfers, all without leaving the app. By using transfers on payment rails that support open banking, the customer’s details are pre-populated and they give their consent via SCA to increase both security and convenience. A further benefit is that this is more cost-efficient as card fees are avoided. Yapily can fully automate this process with Variable Recurring Payments (VRPs) for UK customers.

Discover how to achieve streamlined account and wallet top-ups!

6. Invoice payments

Time of the month to settle the invoice payment? Similar to account top-ups, businesses have to rely on logging into their online banking platform, and manually input the invoice details and account numbers. In turn, invoices may be paid late, or the payer could input the wrong details leading to friction and confusion.

Upgrade the efficiency with generation of payment requests and share in the most convenient way; links, email or SMS. A simple redirection sends the payer to a secure and seamless flow so they can pay directly from their account. No entry of details, no frantic searching for the invoice number, and instead a better user experience where all invoices get paid on time.

7. Bulk Payments

Accounting firms are inundated with processing multiple individual payments considering vast numbers of invoices and payroll management. This also means high processing costs with fees incurred on each individual payment, as well as an operational overhead with long processing times and manual data entry.

Yapily Bulk Payments for our UK and Germany customers allows for a group of payments to be initiated from one account to multiple recipient accounts in a single transaction. Not only does this automation reduce the operational overhead and supercharge your efficiency, but it also reduces the associated fees.

8. Innovation

The accounting industry is ripe for innovation to drive better results and get the competitive edge. Problems need to be solved and customers need to be acquired and existing ones retained. Accessing more accurate and comprehensive financial data in real-time means a more complete view of the customer’s business performance.

Your accounting company can utilise this information to:

Have a greater depth of understanding of the business’ financial health to offer loans with confidence

Develop personalised and accurate financial planning tools

Provide real-time insights and alerts of their customers’ financial activities

Next steps

Now you’re aware of the impact open banking payments and data can have on the accounting industry, it’s time to get set up with a solution. Is your priority to increase efficiency, cut costs, or streamline your accounting process to new heights? Our team of open banking experts are on hand to help you familiarise yourself with the products and the impact it can have on your business.